When it comes to day trading, the big question every trader eventually faces is: Should I trade stocks, forex, or crypto?

Each of these markets offers unique opportunities and risks. Stocks are trusted and well-regulated, forex is massive and highly liquid, and crypto, though volatile, still promises good rewards.

If you're wondering which one best fits your trading style, this article breaks it all down, from trading hours and volatility to pros, cons, and what kind of trader each market suits best.

Stocks vs. Forex vs. Crypto

Before you decide which market to day trade, it helps to know what sets each one apart.

Stocks

Day trading stocks means buying and selling shares of publicly listed companies on the same day. Traders profit from small price movements influenced by earnings reports, market news, and overall sentiment.

Stock markets operate during fixed hours (9:30 AM – 4 PM EST in the U.S.), which gives traders structure but also limits flexibility. The stock market is moderately volatile, with high liquidity, strong regulation, and reliable long-term growth. Stocks are suitable for traders who like predictable market hours and value company research and fundamentals.

Pros and Cons of Daytrading Stocks

Pros:

- Stocks are very reliable and operate in a regulated market.

- You can trade on very safe platforms, with your money insured.

- Commission fees are low.

Cons:

- You can not trade on the weekends.

- Its profit potential can be low, especially when trading in penny stocks.

- Not a suitable market for day traders, as stocks require long-term trades.

- Frequent buying and selling of stocks can attract high transaction costs.

Forex (Foreign Exchange)

The forex market is where traders buy and sell global currencies like EUR/USD or GBP/JPY. It's the largest financial market in the world, with over $7 trillion traded daily.

Forex trading runs 24 hours a day, 5 days a week, offering unmatched flexibility. Traders often use leverage to amplify small price movements, but that also magnifies risk. Forex is the largest and most liquid market, highly regulated, with low volatility and low trading costs, making it ideal for swing trading but less suitable for day trading or long-term investing. The forex market can be volatile, but skilled traders may capitalize on this volatility or more profits.

But they can also face significant losses if the market moves unexpectedly against their positions, especially during major economic announcements like interest rate updates or employment reports.

Traders who enjoy global economics, flexible schedules, and technical trading will trade forex successfully.

Pros and Cons of Daytrading Forex

Pros:

- Forex is the largest financial market with a high trading volume, allowing day traders to execute large trades quickly and with minimal price changes, making it easy to enter and exit positions efficiently.

- The Forex market operates 24 hours a day on weekdays; traders can buy and sell at any hour, giving them the leverage to react instantly to economic news or events that impact prices.

- Forex trading is often cost-effective because it usually doesn't involve traditional exchange, regulatory, or data fees, and many brokers even offer commission-free trading.

- Forex brokers often provide leverage ratios of 100:1 or higher in some regions, allowing traders to control large positions with only a small amount of capital.

Cons:

- The Forex market is susceptible to market volatility, as sudden price movements triggered by central bank decisions, economic data releases, or geopolitical events can result in losses.

- Forex can be complex for beginners; the market is influenced by a wide range of factors, and understanding these factors might take a lot of time. A lot of patience is required to master the market.

- The Forex market's vast size and decentralized structure can make it vulnerable to issues such as price manipulation or the spread of misleading information by influential participants.

Read More: Top Day Trading Courses in 2025: What Works, What Doesn't & How to Choose the Best One for You

Cryptocurrency

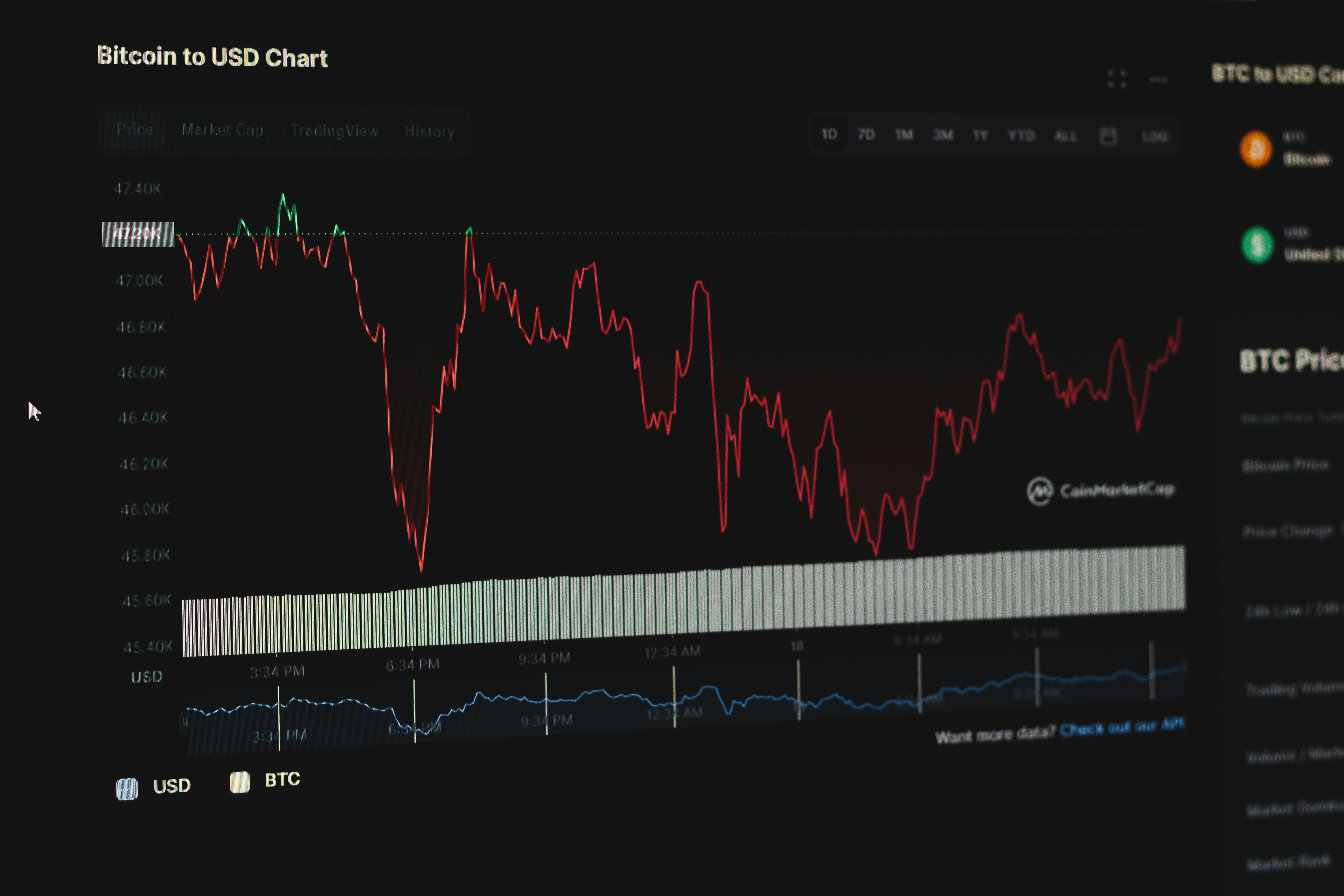

Crypto day trading involves digital assets like Bitcoin, Ethereum, and Solana. The crypto market is open 24/7, meaning you can trade anytime, weekends included.

It's also the most volatile of the three markets, with prices capable of swinging 5–20% in a single day. That volatility creates opportunities for big gains but also steep losses. Traders who are risk-takers and traders who thrive on volatility and fast market action like trading crypto markets more.

Crypto offers massive breakout potential, strong momentum trading opportunities, high leverage, and great long-term upside, but it also comes with high risk, frequent pump-and-dump activity, and many unregulated exchanges.

It's essential to note the key differences and comparisons before entering any of these markets. While forex excels in stability and low fees, crypto dominates in volatility and profit potential, and stocks remain the most balanced choice for both short-term traders and long-term investors. Selecting the right market ultimately depends on your risk tolerance, strategy, and trading style.

Pros and Cons of Daytrading Crypto

Pros:

- Crypto is a great financial asset to day trade as it offers fast profits from short-term price movements.

- You can trade at any time, including weekends.

- You avoid holding positions overnight, which helps reduce exposure to unexpected overnight market swings.

- Helps day traders improve and diversify their portfolio.

Cons:

- Daytrading crypto can be very stressful and mentally draining due to how volatile the market is. Many traders struggle due to the market's complexity and the emotional pressure involved.

- Demands sharp focus and the ability to make decisions quickly.

- Frequent trading can lead to high fees and spreads, which may eat into your profits.

Which Market Should You Choose?

For steady growth and structured markets, you can day trade the stock market. Choose forex if you enjoy analyzing charts, tracking global trends, and trading with flexible hours.

The crypto market is suitable for day traders who are comfortable with volatility and can manage emotional ups and downs.

Pro tip: You don't have to stick to just one; many traders diversify by holding long-term stocks while day trading forex or crypto for short-term opportunities.

If you're thinking of exploring a new trading market:

- Start with a demo account to learn without risk.

- Keep your risk per trade below 2% of your capital.

- Adjust your strategy; what works in forex might fail in crypto.

- Always keep an eye on news and global events that move markets.

Final Thoughts

Day trading in itself is a profitable market, even with the obvious risks. Before delving into any new market, first understand the benefits and risks involved. There is really no single "best" market for day trading. Stocks are stable and structured. Forex is liquid and global. Crypto is fast and volatile. The key thing here is to choose the one that fits your strategy, schedule, and risk appetite.

Always remember to apply discipline, good risk management, and continuous learning to become a successful day trader.

Learn More: 50+ Day Trading Terms Every Trader Should Know (Beginner-Friendly Guide)

Frequently Asked Questions

Which market is best for beginners: stocks, forex, or crypto?

Stocks are generally the easiest for beginners because they are well-regulated, less volatile than crypto, and easier to analyze using company fundamentals. Forex and crypto require deeper technical knowledge and stronger risk management.

Is forex easier to day trade than stocks?

No. Forex is highly liquid and operates 24 hours a day, but it can be difficult for beginners due to its sensitivity to global news, economic events, and interest rate decisions. Stocks are more structured and easier to understand.

Is crypto better for day trading than forex?

Crypto offers higher volatility and bigger profit potential, making it appealing to aggressive traders. However, the risks are much higher. Forex is more stable and predictable, while crypto can swing 5–20% in a single day.

Can I day trade all three markets at the same time?

Yes. This will require lots of skill and time. Many traders combine long-term stock investing with forex or crypto day trading. Just ensure you don't overextend yourself; each market behaves differently.

Which market has the lowest fees for day trading?

Forex typically has the lowest fees because many brokers offer tight spreads and zero commissions. Stocks also have low commission fees, depending on your broker. Crypto often has the highest transaction fees.

Which market is the most profitable for day trading?

Crypto has the highest profit potential due to extreme volatility. However, it's also the riskiest. Forex and stocks offer lower volatility but more stability and predictability.

Can I start day trading forex, stocks, or crypto with a small amount of money?

Yes. You will need less than $50 to trade across all the markets. And also depending on the broker.

Do technical indicators work across all three markets?

Yes, but their effectiveness varies. Technical analysis works best on forex and stocks. Crypto can be unpredictable on lower timeframes due to extreme volatility and a smaller market size.

Follow Us On Social Media